If your Sol is not multiplying while you sleep, then you are doing something wrong. Many of us have grown all too familiar with the shortcomings of the traditional financial system, where banks leverage your deposits to turn a profit, often without passing any of the earnings onto you. This may vary depending on how much you have or what banking plan you subscribe to but there is a high possibility you may not get access to any passive interest on your money. Yet, this doesn't hinder these institutions from profiting off even the smallest of your deposits.

It’s even crazier in my country, where you pay ridiculous charges at the end of each month—so much so that you could end up with a negative account balance if you have no more for them to debit. We know all these setbacks, and oftentimes, what first drew the majority of us to the foundational principles of cryptocurrency.

However, the journey doesn't end with converting your fiat into crypto; it's just the beginning. The true challenge, and opportunity, lies in putting your money to work for you by finding ways to earn passively on idle funds lying in your wallet.

Through personal research, I’ve observed that many people hold their crypto in centralized exchanges, clinging to hope for a future surge in value. It was even more startling to discover that the majority are unaware of the potential to earn passively on their holdings without risking it in futures trading and other high-risk options for earning in crypto.

If you're one of those in the dark about such passive earning opportunities, consider this your lucky day. And if you're already in the know but would love to explore more options for your Sol investment, then this article is for you.

In this article, I will be covering the basics of staking, and liquid staking, including a step-by-step guide on leveraging SolBlaze for earning interest on your SOL. It's about time to put your SOL to work.

But before I move into details of liquid staking and doing it on SolBlaze, it's very important to understand the foundation upon which these innovations stand—the Solana ecosystem.

Brief Introduction to the Solana Ecosystem.

Solana is a decentralized blockchain network first proposed by Anatoly Yakovenko in 2017 and launched in 2020. It is currently one of the fastest-growing Layer 1 networks in the crypto ecosystem and is known for facilitating high-speed transactions and low transaction fees.

At its core, Solana employs a unique consensus mechanism that ingeniously combines Proof of Stake (PoS) with Proof of History (PoH), setting it apart in terms of efficiency and speed. This innovative foundation is not just a technical achievement but a cornerstone for Solana’s mission to power scalable, user-friendly applications (dApps) globally, a vision strongly highlighted on its official website and documentation.

Remarkably, the network maintains an average transaction cost that is almost negligible, and it can handle up to 65,000 transactions per second at peak times—significantly surpassing the capabilities of other networks. This unparalleled performance is instrumental in Solana’s role in driving mainstream adoption of different blockchain innovations like Non-Fungible Tokens(NFTs) and Decentralized Finance (DeFi) applications e.g. liquid staking, lending and borrowing platforms, et. c.

The network's native token, SOL, is super important and a central part of the Solana ecosystem because it powers transactions and facilitates operations within the ecosystem. Basically, you can see why SOL is one asset you might want to consider having in your portfolio.

Now that you have a bit of background into the Solana ecosystem and a glimpse into why SOL could be a valuable addition to your wallet, let’s talk about staking.

What is staking?

Staking is simply a means of earning passive income by locking your cryptocurrency in order to accumulate a certain percentage of the staked token as a reward over time. When you stake your cryptocurrency, it is used in performing essential network tasks such as validating transactions and creating new blocks on blockchain networks that operate on a Proof of Stake (PoS) consensus mechanism. Notable examples of such networks include Ethereum and Solana. So, the reward you get is compensation for your contribution to the network's security, integrity, and scalability.

Traditional staking has its perks; however, aside from the possibility of ending up with a highly centralized network, another limitation of traditional staking is that your funds are locked for a predetermined period, and accessing them before this period ends can incur penalties. So, in a case where you have an emergency that requires urgent financial attention and your money is staked, what do you do? This is exactly one of the problems liquid staking solves, mitigating the rigidity of traditional staking methods.

What is liquid staking?

Liquid staking is a cryptocurrency innovation that allows you to earn passive income through staking rewards while also getting a liquid asset that can be easily traded, sold, exchanged, and used in DeFi like any other token. Essentially, with liquid staking, you stake your crypto and, in return, receive a token. This token represents your staked cryptocurrency that is earning interest and is often referred to as a liquid staking token or a derivative token.

It’s just as simple and amazing as it sounds.

What problem does liquid staking solve?

Unlike traditional staking, which requires your funds to be locked up—leaving you without access to your funds until you unstake your tokens—liquid staking offers flexibility. When staking your crypto assets, you receive a proportional amount of a proxy token, based on the specific liquid staking pool's terms and conditions. These proxy tokens can be used to carry out different transactions across the DeFi ecosystem without needing to unstake your original assets.

To further help you differentiate between traditional staking and liquid staking, here’s a table below highlighting their key differences:

| Traditional Staking | Liquid Staking |

| Tokens are locked up for some time and cannot be traded during this period. | Tokens are staked but represented as liquid tokens that can be freely traded or used for other DeFi applications. |

| Limited/ No flexibility. | Participants retain flexibility and liquidity. |

Now that you understand the clear difference between staking and liquid staking, let’s talk about Solblaze and how to stake your sol on SolBlaze.

What is SolBlaze?

SolBlaze is a liquid staking platform, which means when you stake your Sol on SolBlaze, you get a liquid staked token in exchange. The points I’ve explained about liquid staking apply to SolBlaze, meaning it differs from traditional staking platforms where you lock your tokens and then earn rewards from it.

NB: If you have your funds in a centralized exchange, you will need to move it to a decentralized exchange. If you don't know which one to choose, you can download any of these: Phantom, Solflare, Backpack, or Metamask.

Bonus: SolBlaze has an upcoming airdrop, so this positions you to benefit.

How to stake on SolBlaze

To stake your SOL on SolBlaze for bSOL, there are two primary methods:

Method One: Staking Directly on the SolBlaze Platform

To stake directly on the SolBlaze platform, you can follow the steps outlined below or simply watch this detailed tutorial video I recorded:

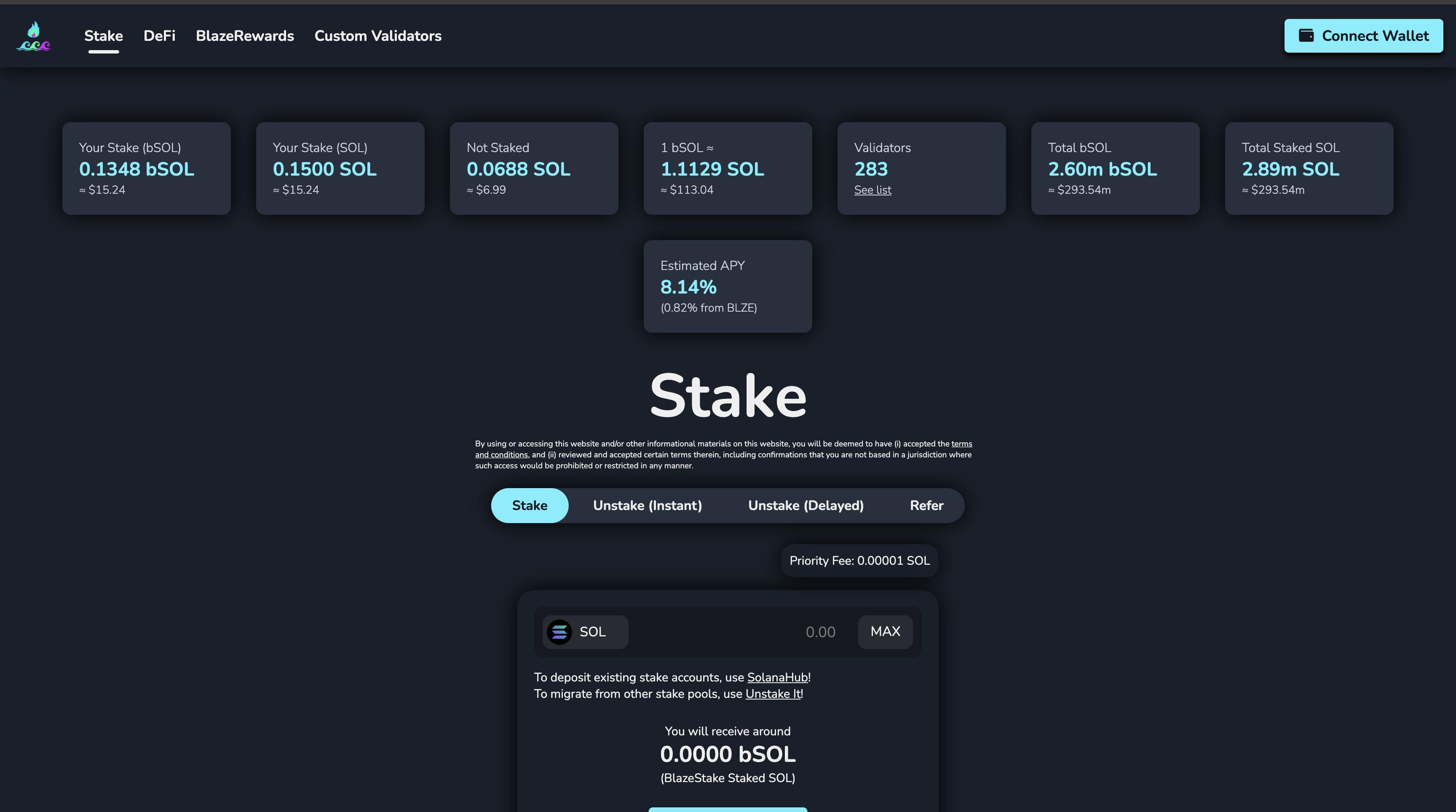

Step 1: Visit the Solblaze website but make sure you have Sol in your wallet. You can easily spot the buttons that will lead you to the staking page. Click it.

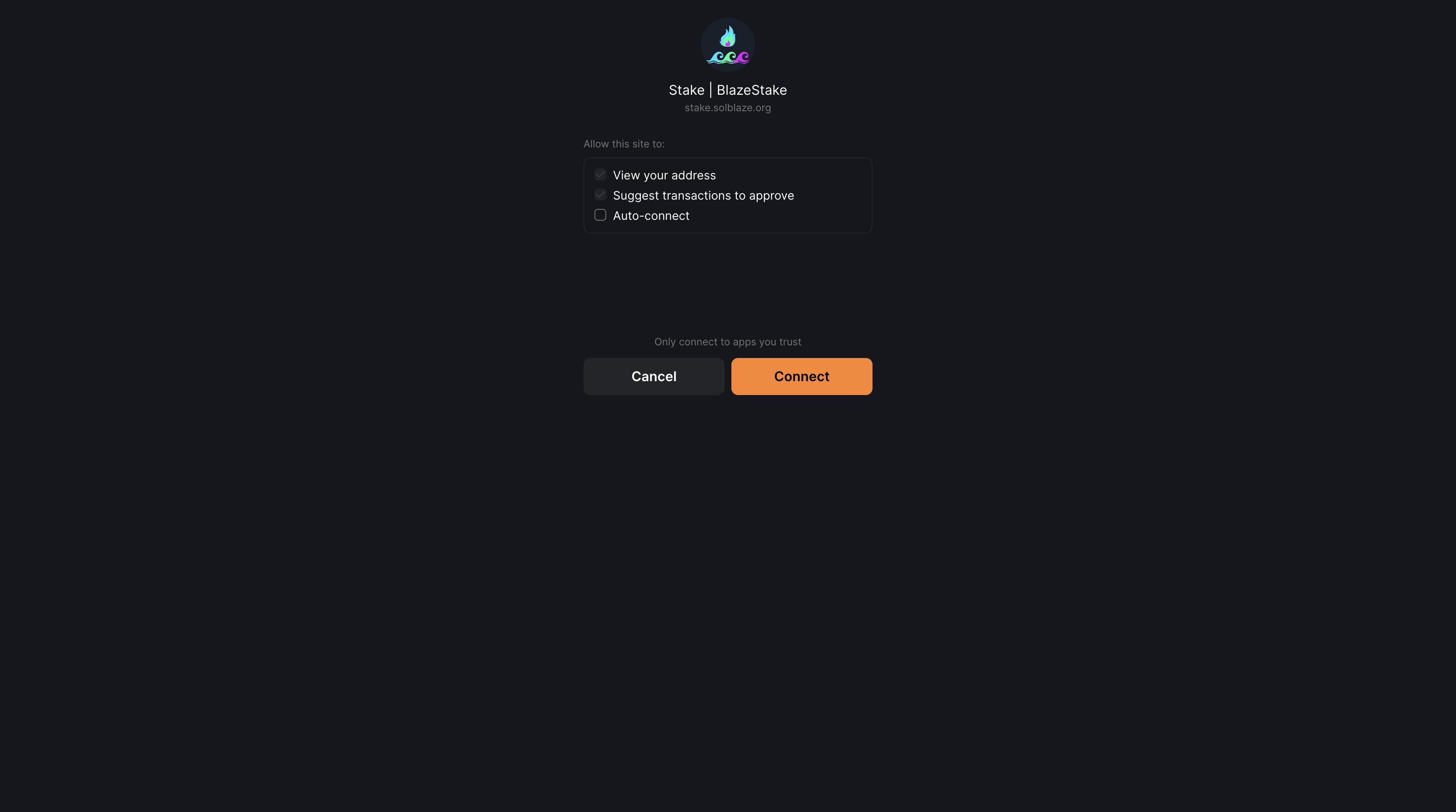

Step 2: Connect Your Wallet. On the staking page, click the "Connect Wallet" button. This action will lead you to select your wallet after which you need to approve the connection. After connecting, it will bring you back to the staking page, ready to stake your SOL.

Step 3: Stake Your SOL. You have to enter the amount of SOL you want to stake in the space provided then click on the "Stake" button. After clicking the "Stake" button, approve the transaction to finalize the staking process.

Your SOL is staked and you get bSOL in exchange immediately.

I will be explaining how you can put your bSOL to use as you read further.

Method Two: Swapping SOL Directly from Your Wallet for bSOL

For direct swapping:

Step 1: Make sure you have SOL in your wallet.

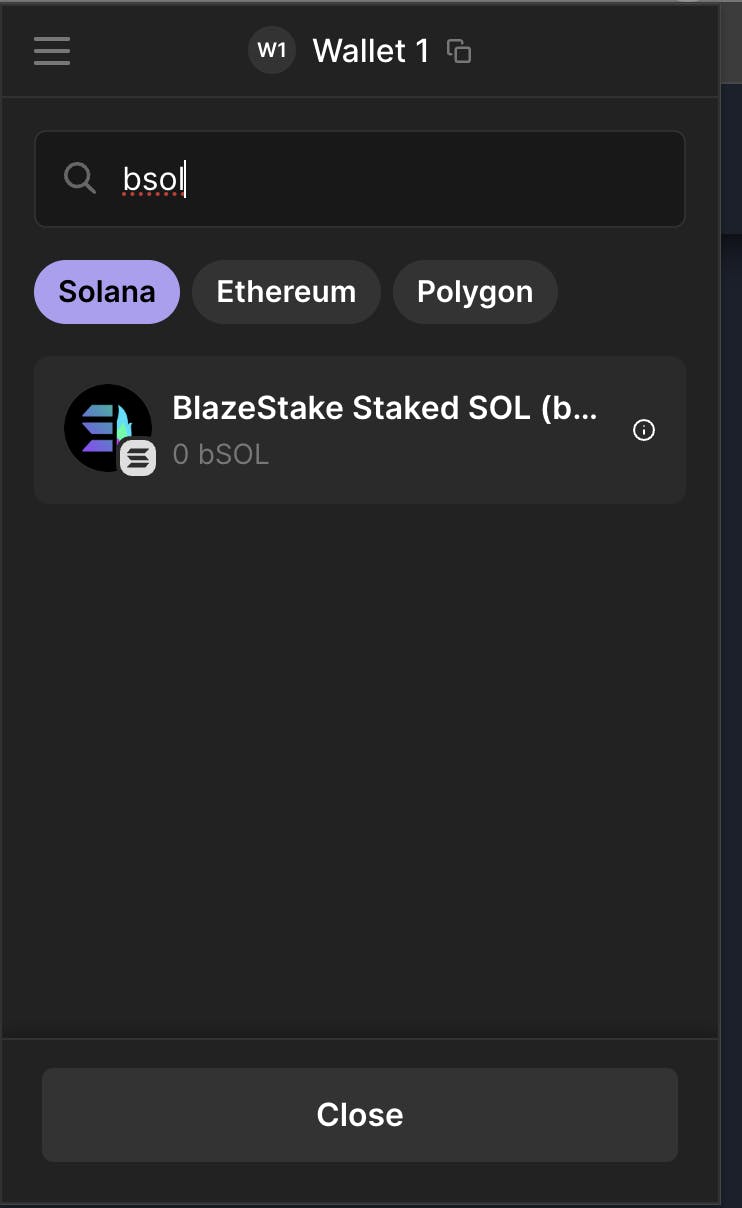

Step 2: Click on the overlaying arrow symbol at the bottom of your wallet. It always leads to the swapping interface. You should see something similar to the image below.

Step 3: Click on "Select Token," search for, and select "bSOL." Enter the amount you wish to swap and confirm the swap. The bSOL will be immediately credited to your wallet.

Note: When you visit the custom validators page on SolBlaze, you can find several options of validators for staking. For a comprehensive understanding of how it works, consider reading SolBlaze's explanatory tweet. However, for simplicity and efficiency, sticking to the SolBlaze staking page is recommended.

How to invest your bSOL

In the intro of the article, I emphasized the importance of putting your money to work constantly. So, now that you have your proxy token from staking on SolBlaze—in this case, our bSOL—it can now be used on other DeFi platforms to make more money.

To do this, you can visit the SolBlaze staking website, where you will find the DeFi section. Once you are on the page, you will see the several platforms available where you can use your bSOL for DeFi activities such as lending, serving as collateral for loans, providing liquidity, and many more. The steps vary depending on the platform you decide to use, but they are easy to use once you do your own research.

SolBlaze Airdrop Eligibility: $𝗕𝗟𝗭𝗘 Token

The benefit of Staking your Sol on the Solblaze platform doesn't end with the flexibility from holding the bSOL or the accumulated earnings but further extends to earning the $𝗕𝗟𝗭𝗘 tokens as a reward. This token is the governance token of the SolBlaze ecosystem and is designed as a reward for your contribution and support to the network’s operations. $𝗕𝗟𝗭𝗘 holders are an integral part of the SolBlaze ecosystem with access to several benefits and can vote on important decisions.

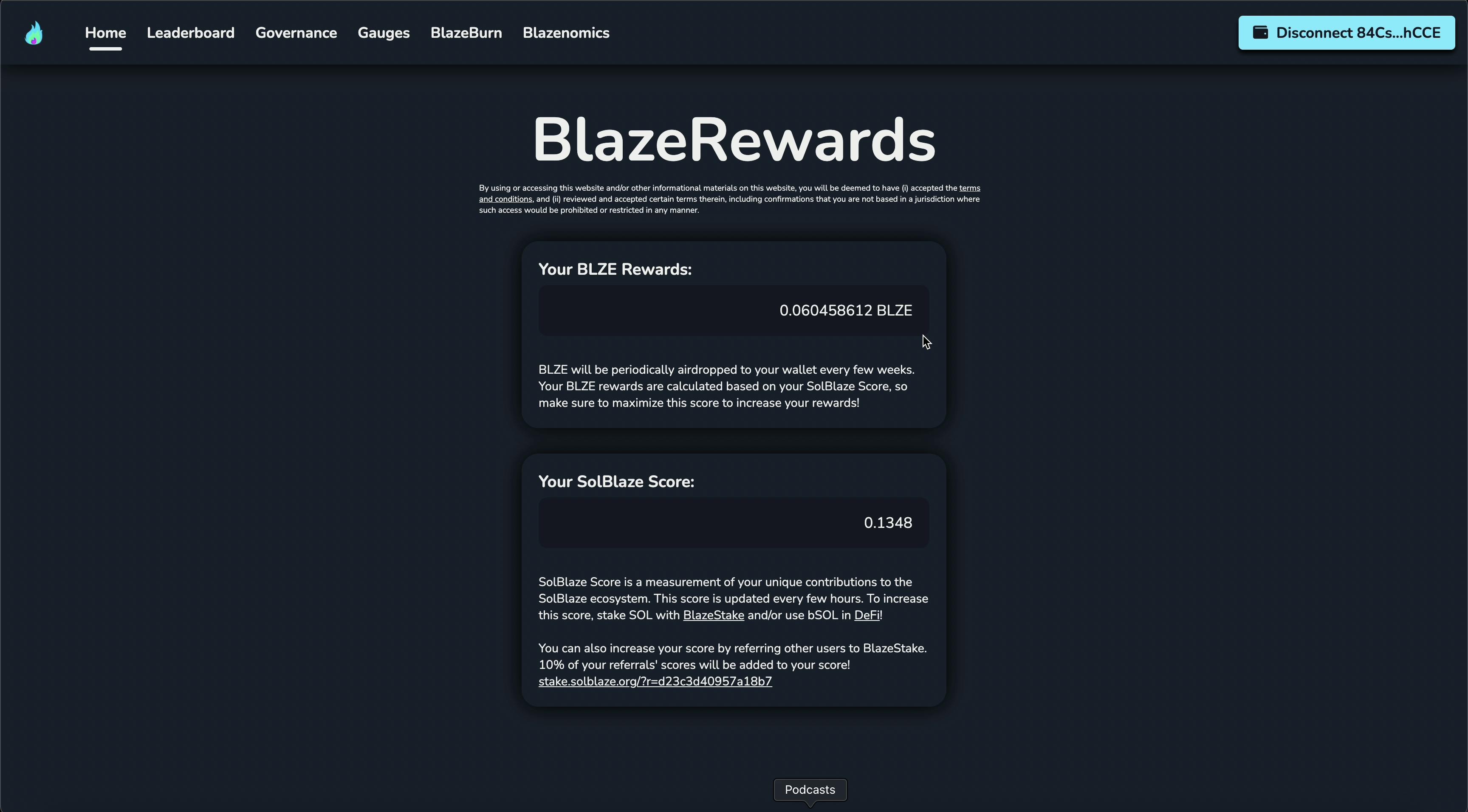

According to the BlazeRewards website, “Your BLZE rewards are calculated based on your SolBlaze Score, and SolBlaze Score is a measurement of your unique contributions to the SolBlaze ecosystem.”

So, the amount of $𝗕𝗟𝗭𝗘 tokens you earn is directly proportional to the amount of SOL you stake and the duration of the staking. After staking, you can immediately check the BlazeRewards section to know how much of the $𝗕𝗟𝗭𝗘 you’ve earned.

Note: The higher and longer you stake, the higher your potential rewards in BLZE tokens. Also, you have to use bSOL in DeFi to be eligible for BLZE airdrops!

Benefits of liquid staking for the Solana ecosystem

Staking is important for the effective running of the Solana ecosystem, and liquid staking brings a new dynamic to achieving this. By lowering the entry barrier and providing a structure that maintains the flow of liquidity within the ecosystem, it introduces significant benefits. Also, being able to use proxy tokens in DeFi has had a huge impact on the growth of DeFi opportunities on the network, driving participation which in turn impacts security and decentralization.

Liquid staking has made a significant impact on the ecosystem, and I strongly believe we are just getting started.

Notable mentions: There are several other amazing platforms driving liquidity flow within the Solana ecosystem. If you would love to explore more options, you can check out Marinade, Jito, and Lido.

Conclusion

SolBlaze has proven to be an emerging industry leader with a fast-growing TVL, closing in on about $3 million, and a high level of transparency with their community. However, just like any investment, liquid staking is not without its potential risks, such as smart contract vulnerabilities, regulatory changes, market volatility, and other risks associated with DeFi investments. This is why it's important to do your research before choosing to invest in a particular platform.

Finally, the importance of putting your money to work can never be overemphasized, but liquid staking makes this process easier by providing you liquidity, alongside other DeFi opportunities, all while you continue to earn staking rewards. By choosing to stake with SolBlaze, investors not only benefit from these advantages but also position themselves to capitalize on upcoming airdrops.

To learn more about SolBlaze, visit: Website | Twitter | Discord | Telegram | Doc

My YouTube guide to staking on SolBlaze: https://youtu.be/Qcz0znDgdlg?si=E8drxStMG0ZdEP0G